Faster Cash, Smarter Rails: Real‑Time Payments and Open Banking for Services

Why Speed Matters in Services

Inside the Rails: How Real‑Time Payments and Open Banking Work

Real‑time networks, explained clearly

In the United States, The Clearing House RTP and FedNow enable near-instant settlement 24/7/365 with messaging designed for confirmations and requests. The United Kingdom runs Faster Payments, the European Union offers SEPA Instant, and Brazil’s Pix powers ubiquitous instant transfers. Each rail has limits, cutoffs, and message types, yet all share reliable speed, finality characteristics, and traceable confirmations that transform receivables predictability for modern service businesses.

Payment initiation, consent, and strong authentication

Open banking payment initiation services guide customers to authenticate directly with their bank using secure OAuth flows and strong customer authentication. Consent explicitly defines who is paid, how much, and when. Tokens and scopes ensure integrity without storing credentials. The result is lower abandonment than manual bank transfers, fewer errors than cards keyed by hand, and clear evidence trails that strengthen trust with finance teams and auditors reviewing payment processes.

Rich data and request‑to‑pay for clean reconciliation

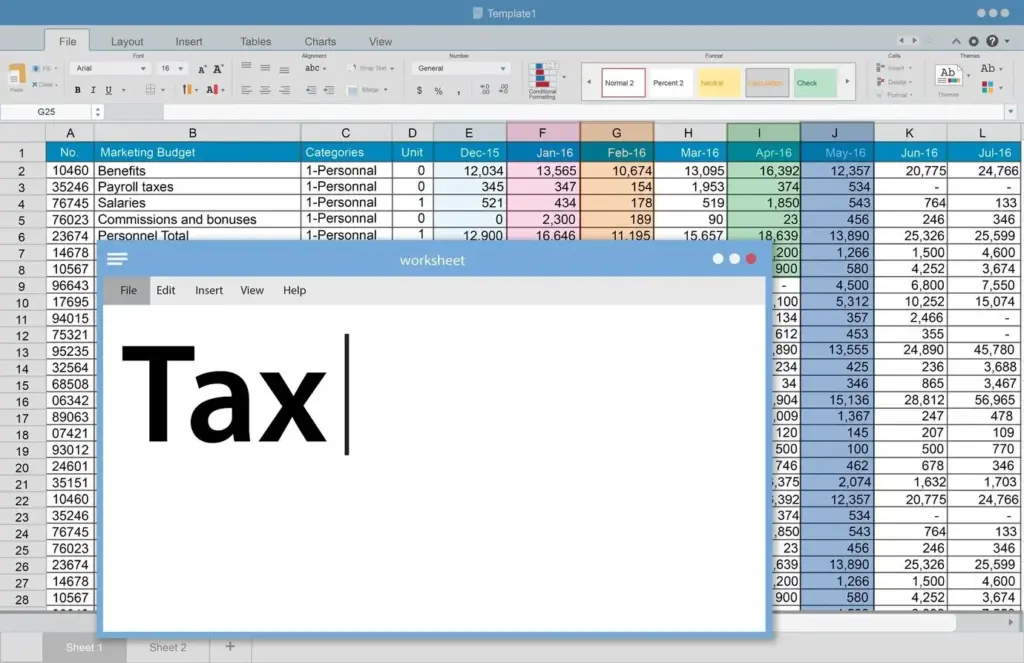

ISO 20022 messages and request-to-pay structures carry references like invoice numbers, customer IDs, purchase orders, and line-item adjustments. When funds arrive, the remittance context travels with them, enabling automatic cash application without emailing spreadsheets or chasing unclear memos. Finance teams spend less time deciphering deposits and more time forecasting, because the payment itself explains the what, who, and why, tightening the feedback loop between operations, billing, and accounting systems.

Implementation Blueprint for Service Providers

Invoice‑to‑payment journey, end to end

Webhooks, idempotency, and resilient integrations

Risk, Compliance, and Trust You Can Explain

Comparing fees and total cost of acceptance

Clean data means lower back‑office spend

Treasury visibility and liquidity gains

Change Management, Measurement, and Momentum

All Rights Reserved.