Sketching Smarter Finance for Service Firms

From Sketch to System

Mapping Client Cash Journeys

Trace every touchpoint where value is promised, delivered, billed, collected, and reconciled. On the board, identify handoffs, dependencies, and ambiguous ownership zones that create delay. Then layer data sources for a unified timeline, including contracts, timesheets, milestones, and approvals. When one legal practice did this exercise, overdue invoices dropped by thirty percent within a quarter, simply by clarifying who nudges whom and when. You can replicate that clarity without buying a single new tool first.

Designing Approval Flows Without Friction

Approvals should feel like supportive guardrails, not bureaucratic roadblocks. By sketching decisions, thresholds, and exception paths in plain language, teams reveal unnecessary loops and redundant sign-offs. Replace email chases with automated, auditable prompts integrated into existing tools your colleagues actually open. Add escalation logic that respects time zones and vacations. One creative agency reduced invoice stuck time dramatically by removing two redundant checkpoints and introducing conditional delegation rules visible to everyone. Transparency, not pressure, accelerates trust and throughput together.

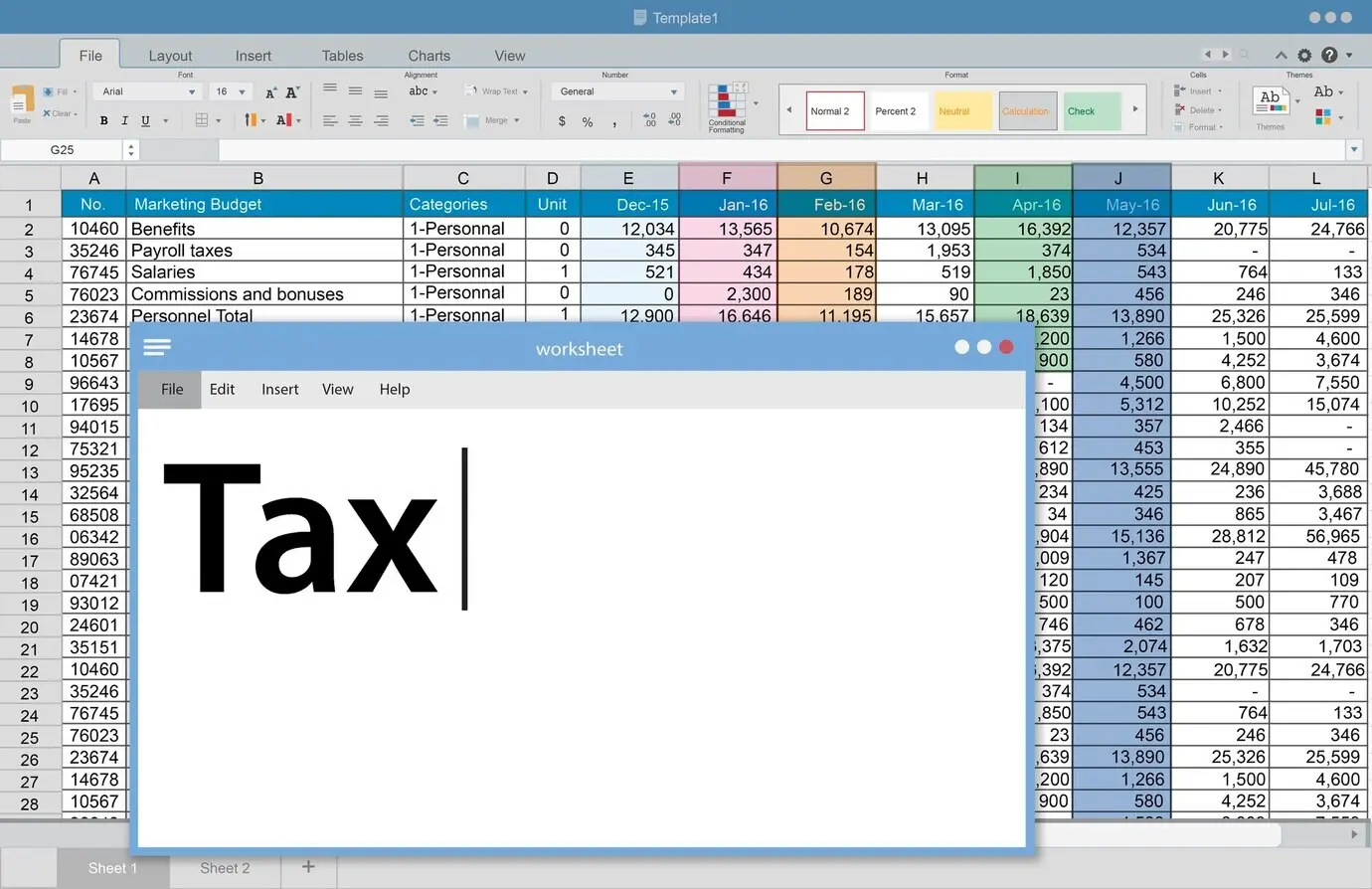

Prototyping Data-Driven Dashboards Live

Build dashboards in front of stakeholders and let the whiteboard decide the information hierarchy. Start with the question, not the chart: what decision must this view support in under thirty seconds? Sketch metrics, filters, and drill paths, then validate with real sample data before styling anything. When a regional accounting firm co-designed revenue forecast panels this way, meetings shortened, forecasts stabilized, and disputes decreased. The magic lies in aligning visual priority with decision urgency, so attention naturally lands where action matters most.

Compliance, Risk, and Trust on the Board

Smart Invoicing That Explains Itself

Flexible Rails: ACH, Cards, RTP, and Beyond

AI Assistance Without the Hype

Collaboration Rituals Around the Whiteboard

One-Hour Blueprint Workshops

In sixty minutes, move from fuzzy pain points to a clear, testable workflow sketch. Start with success criteria, list constraints, then draft a path that survives those constraints. Assign pilots and next steps before leaving the room. Invite cross-functional skeptics early; they save weeks later. A services firm discovered a faster invoice path simply by aligning language between sales and finance. Short, focused workshops build trust quickly, because people see their ideas captured faithfully and turned into action without delay.

Stakeholder Storyboarding Sessions

Create a frame-by-frame journey showing what each stakeholder sees, decides, and feels at every step. Include screens, emails, approvals, and waiting moments that reveal hidden frustration. When people understand one another’s constraints, negotiation becomes design. A legal practice used storyboards to replace tense handoffs with calm, automated transitions. The visual narrative exposes bottlenecks without blame and invites creativity without chaos. Storyboarding honors both the client’s expectations and the team’s limits, leading to solutions that stick because everyone helped write them.

Sprint Reviews with Real Metrics

End each sprint by connecting delivered changes to agreed business measures. Show lead time, error rates, and cash acceleration, not just screenshots. Invite questions that challenge assumptions and celebrate learning from misses. One consultancy doubled stakeholder confidence by making these reviews predictable and honest. When metrics drive the conversation, investment decisions feel rational and energizing. The whiteboard becomes a scoreboard and a planning canvas, turning continuous improvement from a slogan into a social habit the whole organization actually enjoys practicing.

Growth Metrics and Outcomes

All Rights Reserved.