Crafting Frictionless Service Checkouts with Client Portals and Digital Wallets

Today we dive into designing client payment portals and digital wallets for a better services checkout experience, uniting speed, trust, and clarity so customers can pay confidently without confusion or delay. Expect practical frameworks, examples from real rollouts, and human stories, like a regional clinic that boosted on-time payments by simplifying invoices and adding Apple Pay. Share your experiences, ask questions, and subscribe to follow new experiments, patterns, and metrics as we iterate together.

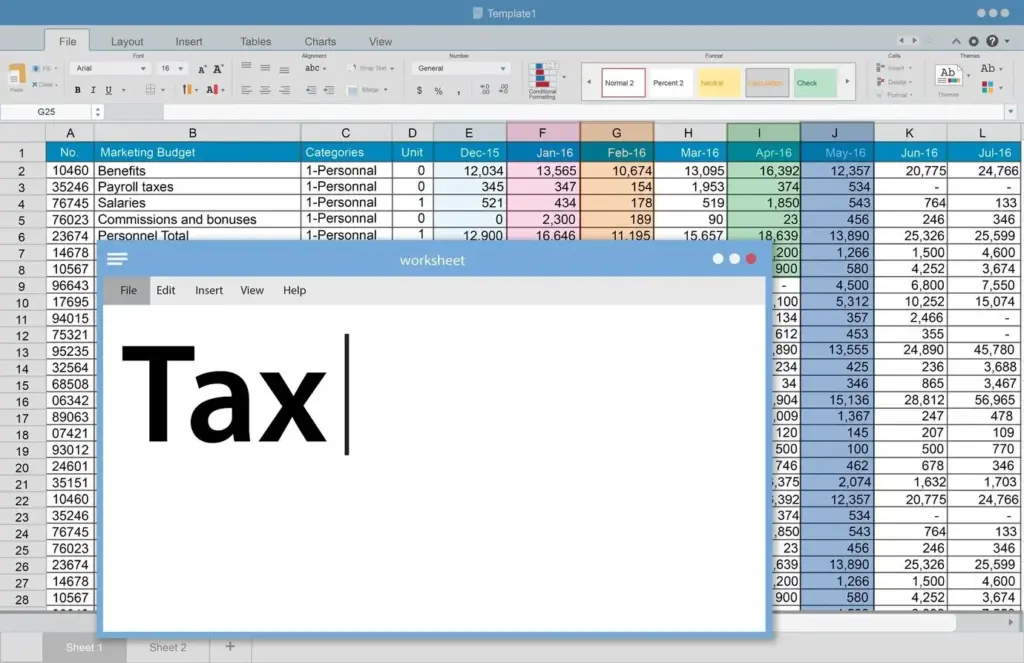

From Invoice to Delight: Portal UX Patterns That Convert

Service checkouts often start with a bill, not a cart. Great portals make that jump painless: one clear call to pay, progress indicators, readable breakdowns, and predictable confirmations. Enable self-service updates to addresses, tax IDs, and saved methods. Offer installment options when appropriate and surface guidelines for reimbursements. Avoid surprise authentication steps and stale session timeouts. When copy and layout anticipate questions, customers breeze through. Reduced cognitive load turns reluctant payers into returning advocates.

Show where the customer is, what comes next, and why it matters. Use a progress header with concise labels and optional details for the curious. Keep the primary action visible without cluttering the view. Offer contextual help that expands inline rather than opening new windows. Summaries should match receipts exactly. One consultancy cut drop-offs by allowing users to preview the receipt before confirming, eliminating fear of misapplied references or missing purchase order fields at the last second.

Give people control over stored cards, bank accounts, and wallets with clear labels, expiry indicators, and simple deletion. Explain tokenization in plain language: you store an encrypted reference, not raw numbers. Ask consent before enabling auto-pay and remind users how to turn it off. Show recognizable card art and last four digits only. A nonprofit increased recurring donations after adding a transparent explanation of how data is protected and an easy pause button for travel months.

Security, Compliance, and Peace of Mind

Reducing risk can increase conversion when done thoughtfully. Keep raw card data out of your environment with hosted fields or tokenization. Limit access using least privilege and short-lived credentials. Support SCA where required while minimizing unnecessary friction through exemptions and risk-based flows. Align to PCI DSS, SOC 2, and regional privacy rules, documenting decisions for audits. Communicate protections simply so customers understand you take care. Security isn’t a barrier; handled well, it becomes a feature.

Choosing the Right Mix by Region and Segment

Match methods to behaviors: corporate buyers prefer invoices and bank transfers; individuals complete faster with wallets. In the Netherlands, iDEAL can outperform cards; in Brazil, PIX speeds settlement; in the US, ACH reduces fees for larger bills. Analyze historical approval rates, refund patterns, and dispute costs to balance convenience with economics. Start small, test, and expand. Over time, prune underperformers to keep the interface focused and operational complexity manageable for support and finance teams.

Express Buttons Done Right on Web and Mobile

Place Apple Pay, Google Pay, or similar buttons near totals with clear benefits like faster checkout and device-level security. Respect brand guidelines without turning the page into a billboard. Use responsive layouts that adapt to available methods and fall back gracefully. Prefill contact details only after explicit consent. One service marketplace shortened completion time meaningfully by detecting eligible wallets early and showing a single confident path to pay, avoiding a wall of tiny, confusing logos.

Performance, Reliability, and Operational Excellence

Speed reduces doubt. Aim for meaningful paint under two seconds, minimize blocking scripts, and lazy-load heavy components after the critical path. Engineer resilience with idempotency keys, safe retries, and graceful degradation for provider outages. Keep customers informed with clear status and immediate receipts. Instrument everything, from API latency to webhook delivery. Chaos drills expose brittle edges before real incidents do. An operations mindset transforms checkout from a point of failure into a dependable, quiet engine.

Measure What Matters and Keep Improving

Let data guide, not dictate. Track funnel steps, abandonment reasons, approval rates by issuer, latency by method, chargebacks, recovery after errors, and satisfaction after payment. Segment by device, geography, and invoice size to reveal surprises. Pair numbers with qualitative notes from support tickets and usability sessions. Run careful experiments with clear hypotheses and guardrails. Close the loop with finance to ensure accounting integrity. Celebrate small wins that reduce friction, then compound them through disciplined iteration.

All Rights Reserved.