Unifying Revenue Where Fintech Meets CRM and PSA

Today we explore connecting fintech capabilities with CRM and PSA systems to unify service firm revenue operations, bringing pipeline, delivery, billing, and collections into one living flow. Expect practical guidance, candid stories, and workable patterns that create real visibility and predictable cash. By aligning data, processes, and teams across the entire customer journey, service organizations can reduce leakage, accelerate invoicing, and empower finance, sales, and delivery to collaborate around a single, trusted view of performance and outcomes.

A Seamless Lead-to-Cash Journey

When sales activity in CRM, delivery progress in PSA, and money movement in fintech follow one connected narrative, speed replaces friction and confidence replaces guesswork. Leads convert to opportunities informed by delivery capacity, scope becomes a contract grounded in actual effort, and billing happens when value is truly realized. This end-to-end alignment reduces manual reconciliation, closes the loop between promises and execution, and lets leaders steer the firm with timely, accurate signals instead of stitched spreadsheets.

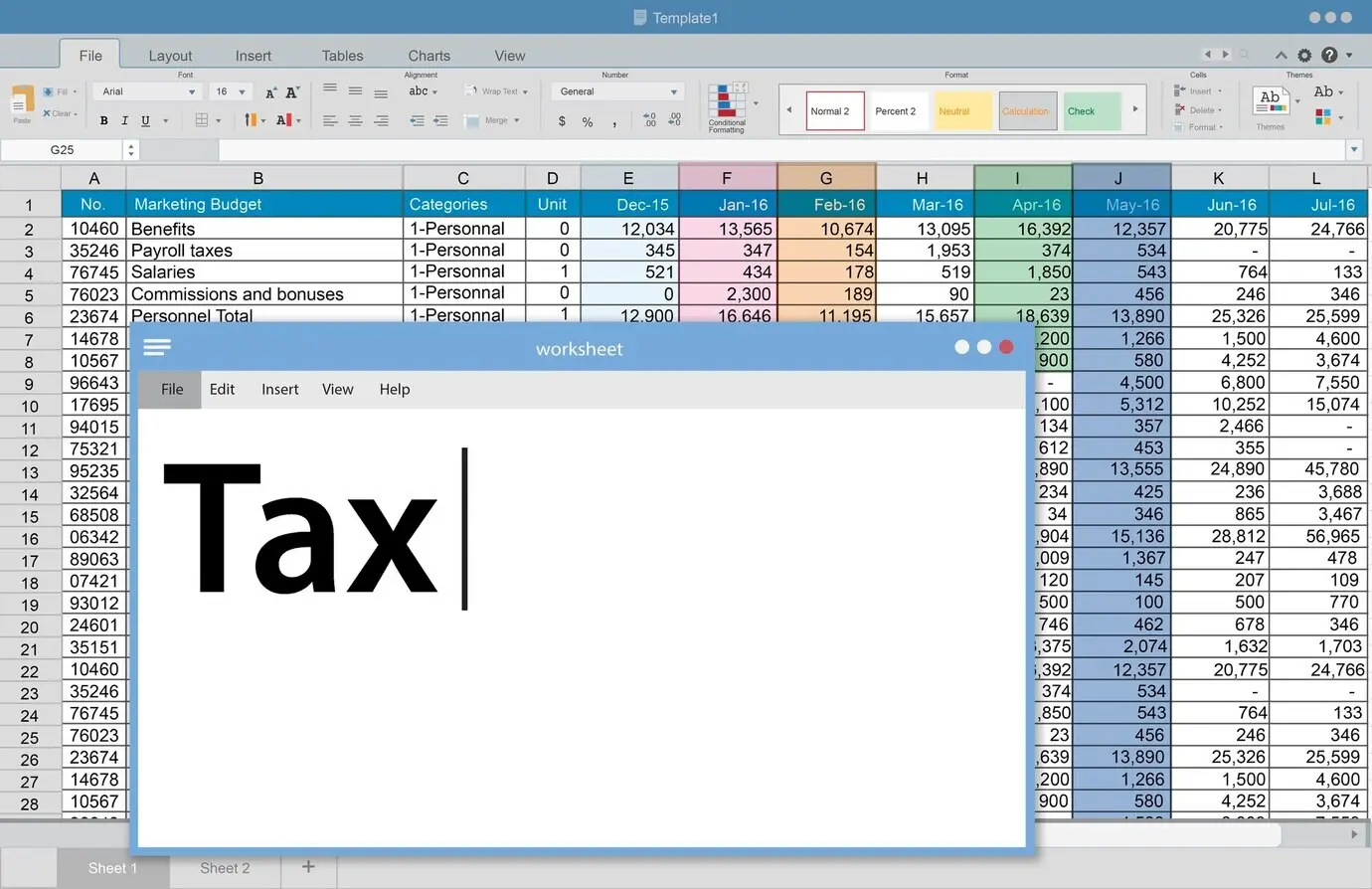

Data Foundations That Make Money Move

Reliable integration starts with shared definitions for customers, projects, products, and services. A golden customer record connecting CRM accounts, PSA clients, and payment profiles prevents duplication and collections confusion. Harmonized catalogs let estimates mirror execution, and financial identifiers bridge invoices, payouts, and revenue recognition. With master data stewardship and clear ownership, information flows cleanly across systems, unlocking automated billing, accurate forecasting, and real-time margin insight that leaders can act on decisively and confidently.

Golden Customer Record and Account Hierarchies

Establishing a single source of truth for legal entities, billing recipients, and shipping or project sites reduces disputes and failed payments. Hierarchies distinguish global parents from regional subsidiaries, enabling consolidated reporting and nuanced credit policies. Synchronizing identifiers between CRM, PSA, and fintech vaults ensures that invoices target the right entity and payment tokens map correctly. Strong stewardship practices, including deduplication rules and merge governance, preserve integrity as your client landscape evolves and expands.

Product and Service Catalog Harmony

When the proposal catalog aligns with PSA task templates and billing codes, estimates translate smoothly into deliverables and invoices. SKU-level consistency supports blended pricing models combining one-off services, retainers, and recurring support. Clear units, rate rules, and tax categories prevent downstream mapping headaches and frustration. Collaboration between sales operations, delivery leaders, and finance keeps the catalog current, enforceable, and flexible enough to support innovation without diluting reporting clarity or compromising gross margin visibility.

Time, Expense, and Milestone Truth

Approved time and expenses must be the single driver for billable events in milestone and time-and-materials engagements. PSA becomes the authoritative source, with validation feeding finance and fintech to trigger accurate invoices. When milestones are tied to verifiable acceptance, billing confidence rises and disputes fall. Consistent policies around submission deadlines, audit requirements, and exception handling create predictable cycles. Transparency into work-in-progress gives leaders early warning on slippage, allowing corrective action before revenue and cash suffer.

Billing, Payments, and Reconciliation Without Chaos

Integrating invoicing from PSA with embedded payments shortens cash cycles and eases client friction. Automated statements, smart reminders, and multiple payment options reduce aging and write-offs. A tight reconciliation loop closes with bank and processor data, producing clear visibility into payouts, fees, and net revenue. With these pieces orchestrated, revenue operations turn predictable: invoices go out on time, customers pay effortlessly, and finance trusts the numbers without chasing spreadsheets or cross-checking partial exports.

Unified Pipeline, Backlog, and Collections Views

A single canvas showing pipeline health, funded backlog, and expected cash collections gives a holistic picture of near-term performance. It prevents double counting and highlights gaps between booked revenue and capacity. With drill-through to deals, projects, and invoices, leaders can validate assumptions and orchestrate corrective actions. This reduces last-minute heroics, improves hiring decisions, and aligns incentives so that everyone contributes to the same, measurable outcomes rather than isolated departmental targets.

Scenario Planning for Capacity and Cash

What-if models test hiring, rate changes, win rates, and payment terms across regions and practices. Tying scenarios to live CRM and PSA data keeps them grounded, while fintech signals refine cash timing. Leadership can explore downside protection and upside capture strategies, deciding where to invest for the next quarter. This capability turns uncertainty into managed risk, enabling bold moves with guardrails. Teams rally behind plans they can see, understand, and adjust as conditions evolve.

Risk, Compliance, and Security by Design

Compliance cannot be an afterthought when payments, client data, and contracts cross multiple platforms. Bake in regulatory alignment, data privacy, and security controls from the first integration sketch. Role-based access, encryption, and audit trails protect sensitive operations without blocking agility. Thoughtful design reduces costly rework, accelerates approvals, and reassures enterprise clients. By embedding these requirements alongside user experience, you achieve both trust and speed, turning compliance into a competitive differentiator rather than a constraint.

Change Management That Sticks

Technology alone cannot unify revenue operations; people, incentives, and habits do. Successful programs establish champions, shared vocabulary, and a cadence of feedback that improves processes continuously. Training follows real workflows, not abstract features. Wins are celebrated publicly, and tough feedback is welcomed without defensiveness. By aligning goals across sales, delivery, and finance, teams see how their actions affect cash and client experience, making the new way of working the obvious, rewarding path forward.

Measuring Impact and Sustaining Momentum

Lasting transformation depends on evidence that matters: faster cash, higher margins, happier clients, and less rework. Define metrics early, wire them into dashboards, and revisit targets as capabilities mature. Share progress candidly, including misses and lessons learned. Celebrate wins linked to specific behaviors and workflows, not just outcomes. Invite readers to comment with their experiences, subscribe for deep dives, and suggest challenges to unpack next. Collective insight keeps improvements honest, relevant, and energizing.

KPIs that Connect Front, Middle, and Back Office

Track opportunity conversion, win cycle time, utilization, variance-to-estimate, invoice cycle time, days sales outstanding, dispute rate, and net revenue retention in one coherent lens. Ensure each metric names an owner and a lever for improvement. When indicators move, teams know what to do next. This alignment turns measurement into action, preventing vanity reporting and reinforcing a culture where data guides decisions consistently across the entire customer and cash lifecycle.

Outcomes, Benchmarks, and Peer Stories

Ground your narrative in outcomes tied to benchmarks, like reducing days sales outstanding by measurable percentages or cutting invoice errors decisively. Pair numbers with real stories: a consultant who reclaimed hours weekly, a finance lead who closes faster, a client who pays happily. These examples inspire belief and help teams imagine their own wins. Invite readers to contribute benchmarks and anecdotes, enriching the collective playbook and sharpening the community’s shared understanding of excellence.

Community, Feedback Loops, and Next Steps

Stay connected with a newsletter, office hours, and a feedback board where questions and ideas shape future updates. We will highlight reader submissions, unpack tricky integrations, and publish templates you can adapt. Comment with your biggest hurdle, and we’ll prioritize a walkthrough. Momentum thrives when participation feels easy and results are visible. Together, we can refine practices that make revenue operations simpler, faster, and more rewarding for every team involved end-to-end.

All Rights Reserved.